Meet the consumer of the future

Retail

342 week ago — 14 min read

For any business, the customer is king. And for as long as there is buying and selling, the king will continue to rule. However, in the past decade, thanks to several market forces, the importance of consumers has been rising with the scales tipping in their favour more than ever before. “The balance of power is shifting toward consumers and away from companies,” said Amazon founder Jeff Bezos underlining the changing equation. Today, customer-centricity is the name of the game and organisations are investing a considerable amount of money, resources and technology towards deepening their understanding of consumers.

But knowing the customer today is half the battle won and will serve businesses only in the short term. To sustain (read that thrive) in the future, in addition to their current efforts, it is critical that businesses think much ahead and pre-empt the changes in consumer behaviour. It’s what customer-centric companies like Amazon and others are investing in. Using technology tools like advanced analytics and AI, they are trying to stay ahead of the game by analysing consumer data, socio-economic and technology trends to get a fair idea of what the customer will be like years from now so that they continue to delight.

As investor Warren Buffet has said, “Someone’s sitting in the shade today because someone planted a tree a long time ago.” Time for preparing for tomorrow, is now. Let’s attempt a gaze at the crystal ball to get a jump on the consumer of the future.

Future Consumer: By Age

MILLENNIALS

When it comes to portraying the future consumer, research after research focuses on a cohort based on a single factor—age. That’s because those born between 1981 and 1997 (popularly known as millennials) will soon be a force to reckon with. Today, 50% of the world’s population is below 30 years old. Of the global millennial population, approximately 58 percent millennials live in Asia. This year (2018), the first of the millennials will become mainstream. By the 2024 general elections, millennials in India will constitute almost 20% of voters. This group will have the numerical muscle to seriously impact outcomes. For instance, if they patronise a product or a brand, nothing can stop it from becoming a cult phenomenon.

Let’s understand what they love based on a Cognizant report 'Retail, Reimagined':

Convenience: Millennials seek an easy and effortless retail experience. They expect the latest technology through their purchase journey—right from researching products, purchase to shipping and delivery. They are in for anything that will enhance convenience for them.

Visual and experiential retail: Millennials expect immersive and interactive customer journeys that are fun. They seek technology-driven one-of-a-kind experiences such as those with augmented reality (AR).

Complementary products and services: Based on their expectation for convenience, millennials see services such as banks, dry cleaners and bistros to be natural extensions of retail.

Digital, real-time promotions: Millennials have disdain for traditional sales events. By 2025, their response to time constrained deals will have had a major impact on sale season. For millennials, promotions are digital, communicated one-to-one and in real-time via mobile devices, in-store and online.

Content: Millennials are riveted by custom content, especially their own. They love brands that allow them to share photos, videos, opinions and experiences and buy on social sites. “For millennials, the concert, the ballgame, the restaurant, the gym, the store –experiences— they’re all just content providers,” according to Sean Walsh, who works on Strategy and Business Development at The Walt Disney Company.

Online as well as offline: Millennials love their smartphones and shopping online. However, First Insight found that only 16% millennials buy using a mobile device—most prefer buying in a store with some buying on desktops. Interestingly, there are behavioural differences between younger (20-23 years old) and older millennials (32-35 years old). Older millennials are more likely than younger ones to buy on their mobile devices, while the latter are more likely to buy at a brick and mortar store. Furthermore, if they are shopping for something online as well as offline, there is a much higher likelihood of them buying it offline than online.

Discounts: Price is a major factor for millennials when shopping, as is value. A majority of them follow brands on social networking sites with the sole intention of getting good discounts and deals. In fact, over 60% say they will switch brands if they are offered a discount of 30% or more.

Social values: Millennials value ethics and socially responsible behaviour. Not only do they want to work for socially / environmentally conscious employers but they are willing to pay for products that are made ethically and sustainably.

GENERATION Z

The next major group of future consumers will be Generation Z, those born between 1996 and mid-2000s. In the next two years, this group will account for 40% of consumers. The Gen Z differs from millennials in several ways. Where millennials are collaborative, Gen Z are private and focused. They also have very short attention spans—on an average, their attention span is 8 seconds and they toggle between a minimum of five screens.

Here’s what the Gen Z loves:

Independence: The generation is self-reliant and wants to do its own things, aided by YouTube tutorials, which is their primary source of self-education, entertainment and advice.

Stores: The generation loves to shop offline. As per an HRC Retail Advisory report, this is a generation of mall shoppers, with 72% going to a mall at least once every month, where they spend at least an hour and go to 4.4 stores per trip to shop for themselves.

Influencers: The generation prefers endorsement by influencers over direct brand advertising and would prefer to see a YouTube video from someone they follow vs. a TV spot from a brand they might like.

Individualistic: As mentioned earlier, representatives of the Gen Z are private people who like to take their own decisions. In addition, they don’t like to be treated as a part of a generic group but as an individual and dislike being defined by a brand.

Seamless technology: Being true digital natives, they are extremely comfortable with technology and expect it to be seamless. They have zero tolerance for technology delays or glitches and expect an absolutely smooth experience across devices.

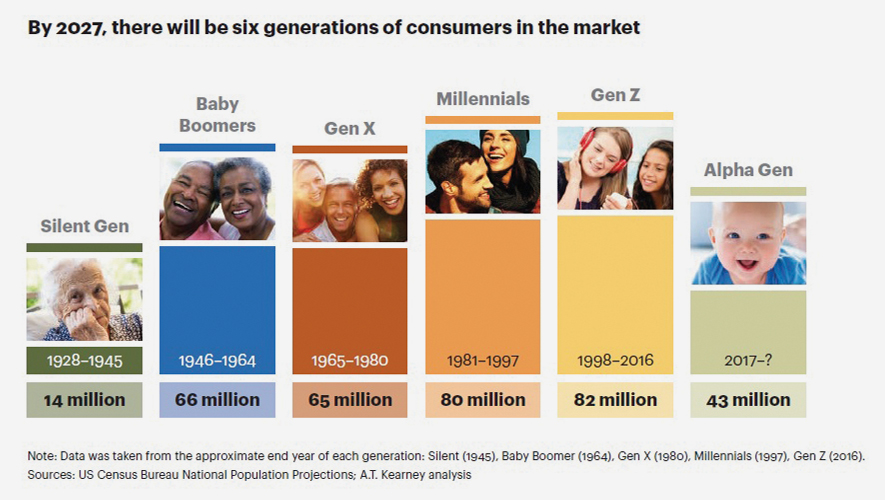

What’s interesting is that even though there will be six generations in the market by the year 2015, the millennials and the Gen Z will dominate consumption.

Future consumers by class

Washington DC-based Brookings Institution recently released its poverty clock for India based on the NSSO Consumer Expenditure Survey data for the period 2011-2012 that suggests that poverty in the country is declining at the rate of 44 people per minute. However, considering data for 2017-2018, it is diminishing at the rate of nearly 100 per minute. There has been a steady increase in the average household incomes leading to an increase in affluence and discretionary spends. By 2025, the elite and affluent will be the two top consumer categories by spends. Both combined, they will become the largest segment of spenders, accounting for 40% of consumption. Most of the growth in this segment is driven by those living in urban areas. By 2025, wealthy urbanites will be responsible for one-third of total consumption. As the proportion of the affluent and the elite increases, that of the next billion and strugglers will decrease to 36%.

Consumer by geography

By 2025, about 40% of the country’s population will reside in urban areas. They will account for over 60% consumption. Interestingly, this growth will not happen in the traditional metros or urban areas, but in emerging small towns that are urbanizing.

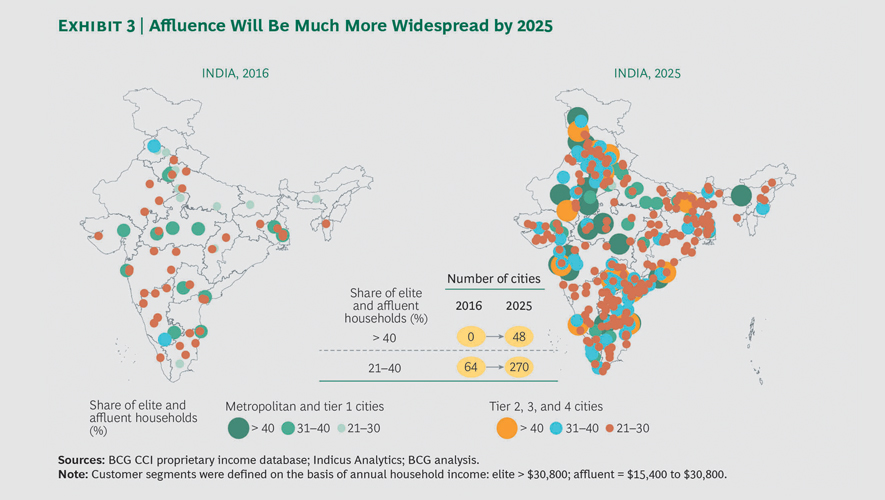

In terms of consumption expenditures, towns with less than 1 million residents will be the fastest growing. These towns have already overtaken India’s biggest cities in terms of consumer spends by as much as 2% a year. BCG expects emerging cities to witness the highest growth in the number of elite and affluent households through 2025.

Emerging cities will see an increase in the number of such households by a factor of over 2.5. In major metropolitan areas such as Mumbai, Delhi, Chennai and Kolkata, the number of affluent and elite households is expected to double. Furthermore, the number of emerging cities with average household income matching major metros will go up to 120.

A large portion of those shopping online will hail from rural areas, thanks to the growing internet penetration, which is likely to grow to 55% or more by 2025, by which time we are likely to have 850 million users. When looking at rural areas as a market, it will serve retail organisations well to consider the influence of digital penetration on consumption patterns.

Future consumers by family composition

The number of nuclear households in the country have increased manifold in the past two decades. Going forward, this is an area that marketers should keep a close eye on as the per person spend in nuclear families is often 20% to 30% higher than that in joint families.

This is because, in nuclear families, the decision makers are often younger and more aspirational than decision makers in joint families and make consumption decisions based on lifestyle and trends. In 2016, the proportion of nuclear families was 70%. It is projected that by 2025, it will be 74%.

An important development on this front is the increase in the number of single households. More and more single working people are moving out of their parents’ homes to live alone in bigger cities. Also, both men and women prefer to delay marriage—a trend observed in not just big metros but even tier-2 towns.

This shift in family structure has an interesting impact on spending as young single men and women base their consumption decisions on lifestyle considerations rather than on functional needs. They are more individualistic, independent and hedonistic and don’t think twice before spending on things that catch their interest.

Future consumers by spending behavior

Researchers predict a progressive shift in the aspirations and spending behaviour of consumers, especially with respect to some categories. The biggest change is that shopping is becoming much frequent and more social (involving family and friends). Furthermore, there is a greater preference for immediate gratification than asset creation. People want experiences rather than products. So they aspire for international vacations, destination celebrations rather than buying things. In addition to immediacy, the slant is towards comfort and convenience, even if it comes at a higher price.

Social media is creating a pressure to fit in and be seen doing cool things, which impacts buying decisions. This will increase going forward.

Also, more and more people across age groups are willing to engage with technology such as virtual reality and custom-made products using 3D printers. Insights from the Oracle Retail 2025 study highlight that consumers will be most willing to engage brands with new technology if they feel that they are in control of their experience. “Consumers clearly indicated that they have a conservative appetite for retail technologies that require deep personal data and make decisions on their behalf,” shared Mike Webster, senior vice president and general manager at Oracle Retail and Oracle Hospitality.

He added that consumers will continue to grow comfortable with sharing their data with trusted brands so that they can enjoy more personalised experiences, along with faster delivery and convenience.

Finally

Digital Analyst Brian Solis observed, “Each business is a victim of Digital Darwinism, the evolution of consumer behaviour when society and technology evolve faster than the ability to exploit it." The solution is to ensure being ahead of the curve.

It’s true that consumers are changing more rapidly than ever before. Thankfully, they are doing so all the while engaging with technology, which makes it easier to understand the shifts. The advanc es in digital technologies like Artificial Intelligence are arming us with a deeper understanding of current as well as future shifts in behaviour. History has proven that companies that have managed to pre-empt and prepare for changes, not just in terms of technology but consumers are the ones that have thrived. Take for example Apple, a company that has managed to rise and rise with each wave of change because its Founder Steve Jobs believed, “Get closer than ever to your customers. So close that you tell them what they need well before they realise it themselves.” A tall order for most organisations. Until your business reaches that level: Understand consumers. Adapt. Pre-empt. Repeat.

To explore business opportunities, link with me by clicking on the 'Invite' button on my eBiz Card.

Article source: STOrai Magazine

Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the views, official policy or position of GlobalLinker.

Network with SMEs mentioned in this article

View Shiv 's profile

Most read this week

Trending

Ecommerce 1 week ago

Comments (2)

Share this content

Please login or Register to join the discussion